📌 Key Takeaways

In Southern California constructive discharge cases, “lost wages” may include income a worker stopped earning after the employment relationship ended, as well as certain regularly earned pay components beyond the base pay.

- A resignation may be treated as a termination if working conditions became so intolerable that a reasonable worker would feel compelled to resign.

- Past wage loss often focuses on what stopped—for example, the hourly wages or salary that ended when the job ended.

- “Wages” may include more than base pay when overtime, shift differentials, piece-rate earnings, production bonuses, or commissions were regularly earned.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

When workplace conditions become intolerable, some California workers resign because they believe continuing the job is not realistic. In certain situations, that resignation may be treated under California employment law as a constructive discharge (sometimes called constructive termination). When constructive discharge is at issue, wage-based economic damages—including “lost wages”—may become part of the legal analysis.

This article provides general information about how “lost wages” may be evaluated in that context for California workers who believe they were effectively pushed out of their jobs. The discussion is often relevant to workers in jobs where steady hours, overtime, or shift pay are a regular part of earnings, including construction, warehouse operations, manufacturing, retail, food service, and delivery.

Some workers also have disabilities or qualifying medical conditions. When a worker requests a reasonable accommodation, participates in the interactive process, or takes job-protected medical leave, an employer’s response may become legally significant. If a worker later resigns after increased scrutiny, reduced hours, discipline, or other adverse treatment, the timing and sequence can matter when evaluating whether the resignation may be treated as a constructive discharge and whether wage-based economic loss may be implicated.

How Constructive Discharge Relates to Wage-Based Economic Damages in California

Under California law, a resignation may, in some circumstances, be treated as a termination. When a resignation is treated as a termination, wage-based economic damages may be part of a claim that the employment ended in a way that may violate the law. A Southern California employment attorney may review how and when pay stopped, how the worker’s earnings changed after leaving, and whether the facts may support a causal connection between protected status or protected activity and the working conditions that preceded the resignation. The evaluation is fact-specific and depends on the details of the workplace, the worker’s role, and the employer’s decisions.

What “Lost Wages” May Mean in a Constructive Discharge Claim

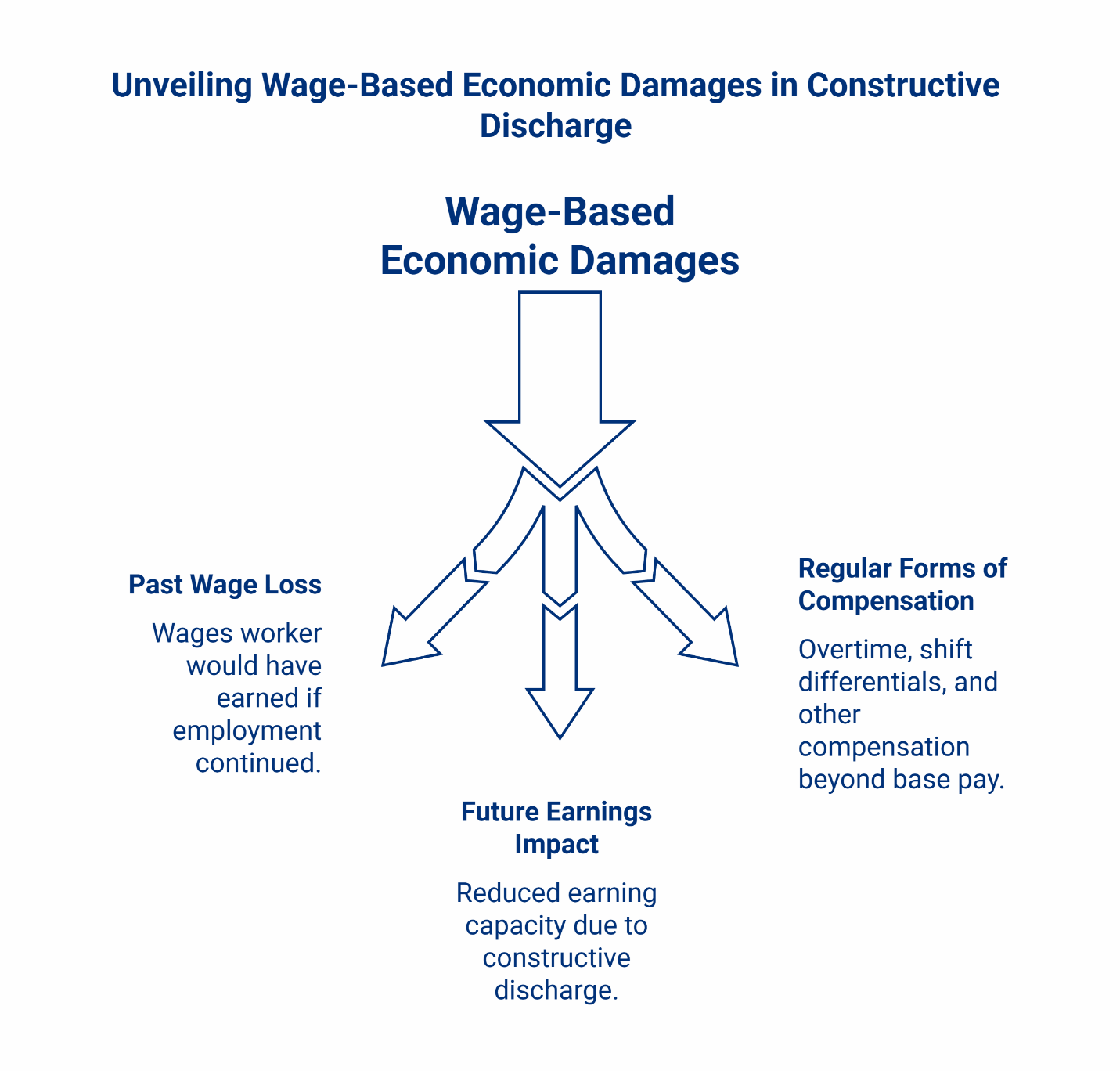

In this context, “lost wages” generally refers to wage-based economic loss a worker may claim resulted from an employment ending that may violate the law. The analysis often focuses on:

- Past wage loss after pay stopped;

- Potential future earnings impact; and

- Regular forms of compensation beyond base pay, such as overtime or shift differentials.

Past wage loss often focuses on the pay a worker likely would have continued to receive if the employment relationship had not ended under conditions that may be unlawful. For many workers, that means the regular hourly wages or salary that stopped on or after the last day of work.

In reviewing past wage loss, an attorney may consider pay stubs, wage statements, schedules, time records, and other evidence showing typical hours and pay practices. The goal is to understand what the worker regularly earned before resignation.

In some situations, economic damages may also consider whether a constructive discharge affects a worker’s earning capacity over time. For example, the worker may later earn less if medical restrictions limit job options or if comparable positions are harder to obtain.

A Southern California employment attorney may examine whether the resignation contributed to reduced earnings, whether the worker could realistically obtain similar work, and how any reduction in earnings may fit within an analysis of wage-based economic damages. Any discussion of future earnings is fact-specific and depends on the worker’s experience, the labor market, medical restrictions, and efforts to obtain new work.

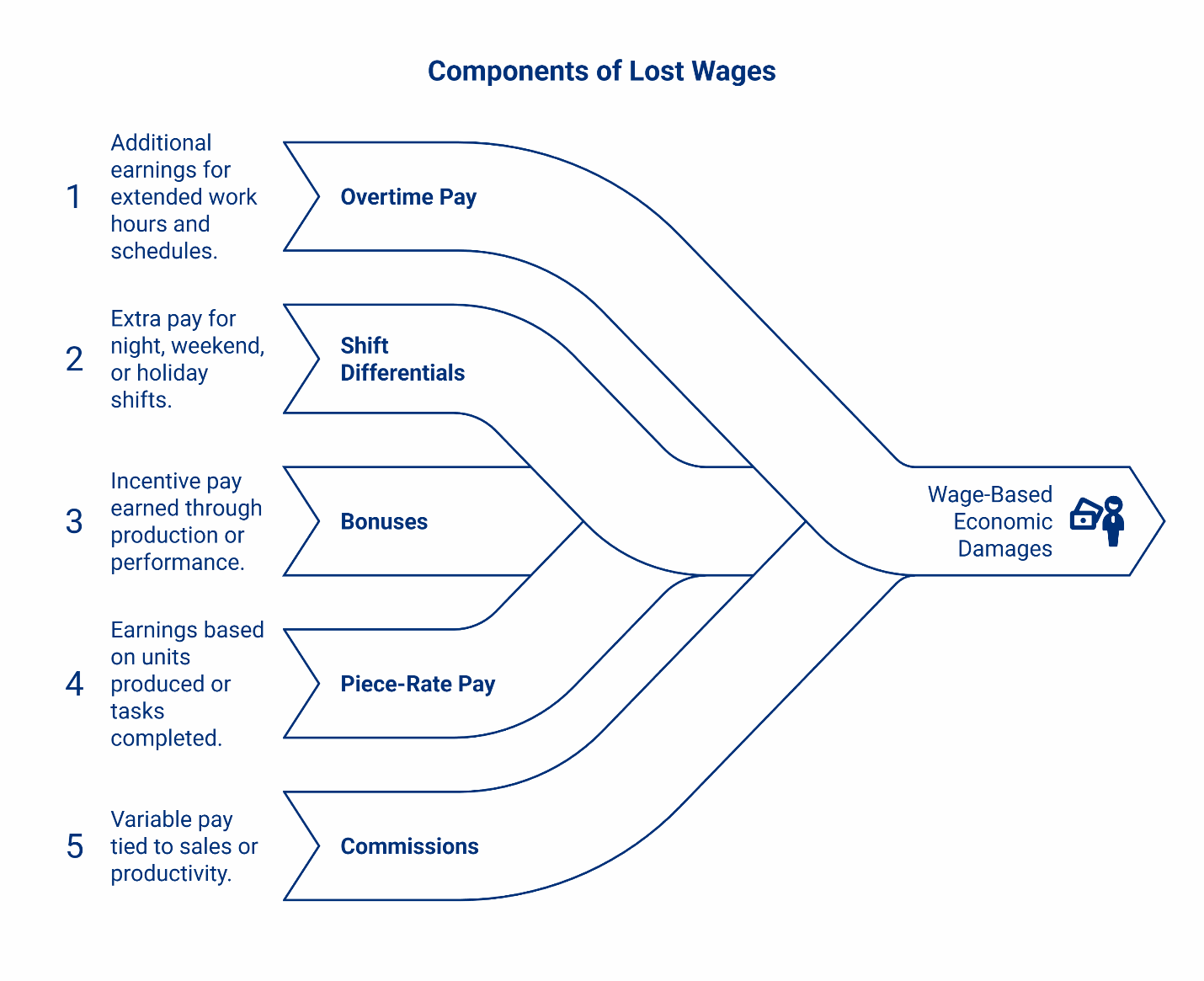

Overtime, Shift Differentials, Bonuses, Piece-Rate Pay, and Commissions

For many California workers, “wages” can include more than a base hourly rate or salary. Regular compensation may also include:

- Overtime pay when long shifts, weekend work, or extended schedules were commonly available.

- Shift differentials for night, weekend, or holiday schedules.

- Production-based bonuses, piece-rate earnings, or other incentive pay that was regularly earned.

- Variable compensation tied to productivity or output.

When a worker alleges constructive discharge, an attorney may evaluate whether these forms of compensation were a consistent and expected part of the worker’s earnings. If so, the loss of those earnings may be considered when analyzing wage-based economic damages.

How Gaps in Work and Lower-Paying Jobs May Affect Wage Loss

Workers do not always move directly from resignation to new employment at the same pay level. Some workers experience time out of work while searching for a new job. Others may need time away from work for treatment, recovery, or medical restrictions that limit the type of work they can accept.

Periods without work can increase wage-based economic loss because the worker receives no wages during that time. Even after a worker is hired elsewhere, the new job may offer fewer hours, limited overtime, fewer shift opportunities, or a lower base rate. The difference between prior earnings and post-resignation earnings is one factor an attorney may review when assessing wage-based economic damages tied to a constructive discharge theory.

Information Workers May Need to Share with a Lawyer When Discussing Lost Wages due to Constructive Discharge

In case evaluations involving constructive discharge and lost wages, attorneys often review documents and basic information that show how income changed over time including but not limited to:

- Pay stubs or wage statements from the prior job, especially from the period before conditions worsened.

- Schedules, time records, or other documentation showing typical hours, overtime, and shift patterns.

- Emails, texts, write-ups, or notes that reflect changes in duties, hours, performance standards, or discipline leading up to the resignation.

- Job-search information and details of any new employment, including pay rate, expected hours, and whether overtime is available.

Workers do not need perfect records before contacting a lawyer. These examples illustrate the types of information that can help an attorney compare earnings before and after the resignation, rather than functioning as a mandatory checklist.

Why Discussing Economic Damages with a California Employment Attorney May Matter

Wage-based economic damages in constructive discharge matters can involve multiple categories of pay, including base wages, overtime, shift differentials, bonuses, time out of work, and reduced hours or lower pay in a replacement job. In some cases, wage issues are intertwined with disability-related issues, requests for reasonable accommodation, participation in the interactive process, job-protected medical leave, or retaliation concerns.

An attorney who handles wrongful termination and constructive discharge matters can review the worker’s employment history, identify which categories of wage-based loss may be implicated, and evaluate whether the facts may support claims under California law, including FEHA where applicable.

If you are located in Southern California communities such as Los Angeles, Bakersfield, Costa Mesa, Temecula, Rancho Cucamonga, Oxnard, Culver City, or San Diego, the same legal concepts may apply regardless of the specific city. The outcome, however, depends on the specific facts, documentation, and timing.

Disclaimer:

This content is for informational purposes only. Laws, definitions, and deadlines change. Verify current requirements through official California sources. This content is not legal advice. No attorney-client relationship is formed through this content. Please consult a qualified attorney in your jurisdiction for legal advice specific to your situation.

Protect Your Rights | The Akopyan Law Firm, A.P.C. | Top Gun Employment Lawyers

Have you been wrongfully terminated from your job? Have you suffered discrimination, harassment, or retaliation in the workplace? Has your employer violated wage and hour laws? If so, we can help. The Akopyan Law Firm, A.P.C. is dedicated to protecting and enforcing employees’ rights throughout Southern California. With a 97% success rate and millions recovered for our clients, our team of experienced and talented employment lawyers can fight to secure the justice you deserve.

Take the First Step Towards Securing Justice: Call us today to speak with one of our experienced employment lawyers. The firm offers case evaluations free of charge.

Contact Us Today:

- Phone: (818) 509-9975

- Office Locations: Los Angeles, Bakersfield, Costa Mesa, Temecula, Rancho Cucamonga, Oxnard, Culver City, and San Diego in California.

Important: Contacting the Akopyan Law Firm, A.P.C. does not create an attorney-client relationship, but all communications will remain private and confidential. Each case is unique. The Akopyan Law Firm, A.P.C., does not guarantee any outcome.